This article describes the formula syntax and usage of the ISPMT function in Microsoft Excel.

Description

Calculates the interest paid (or received) for the specified period of a loan (or investment) with even principal payments.

Syntax

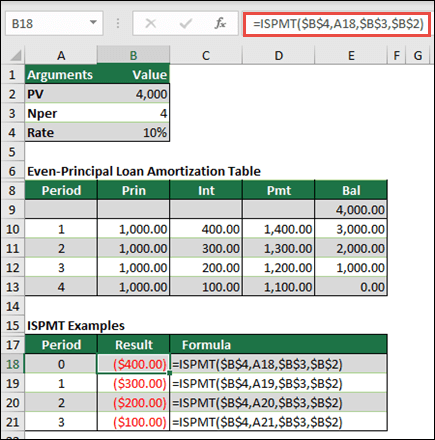

ISPMT(rate, per, nper, pv)

The ISPMT function syntax has the following arguments:

|

Argument |

Description |

|---|---|

|

Rate |

Required. The interest rate for the investment. |

|

Per |

Required. The period for which you want to find the interest, and must be between 1 and Nper. |

|

Nper |

Required. The total number of payment periods for the investment. |

|

Pv |

Required. The present value of the investment. For a loan, Pv is the loan amount. |

Remarks

-

Make sure that you are consistent about the units you use for specifying Rate and Nper. If you make monthly payments on a four-year loan at an annual interest rate of 12 percent, use 12/12 for Rate and 4*12 for Nper. If you make annual payments on the same loan, use 12% for Rate and 4 for Nper.

-

For all the arguments, the cash you pay out, such as deposits to savings or other withdrawals, is represented by negative numbers; the cash you receive, such as dividend checks and other deposits, is represented by positive numbers.

-

ISPMT counts each period beginning with zero, not with one.

-

Most loans use a repayment schedule with even periodic payments. The IPMT function returns the interest payment for a given period for this type of loan.

-

Some loans use a repayment schedule with even principal payments. The ISPMT function returns the interest payment for a given period for this type of loan.

-

To illustrate, the amortization table below uses an even-principal repayment schedule. The interest charge each period is equal to the Rate times the unpaid balance for the previous period. And the payment each period is equal to the even principal plus the interest for the period.

Example

Need more help?

You can always ask an expert in the Excel Tech Community or get support in Communities.